This article is made for tradingtoolx.com members in mind ,Feel free to tweak according to your risk appettite.In this article , we are going to see three types of Risk management.

Before I cover all these topic , let me explain the common rules you need to follow for all kind of trading.

Common Rules

- Never risk more than 2% of your capital in a single day.

- Have atleast 1:1 Risk Reward

- Never trade without stoploss

- No target , Trail your profits

Risk calculator

**click on above rows to see the list of trades.

I have created above calculator to help you visualize , how much you lose or how much you gain if you are risking fixed percentage of capital per trade / per day. For example if your capital is 1 Lakh and your risk per day is 2% of capital , Even if you are losing continously for 19 days , you will be losing only around 30% of your capital. We will see more of this as example in coming sections.

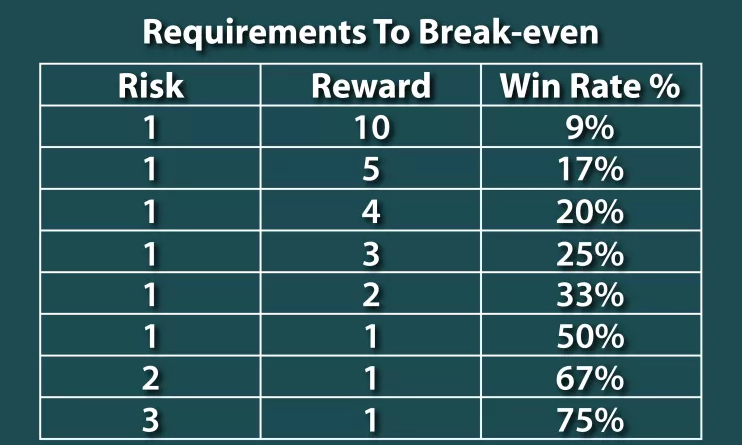

Importance of Risk Reward

In above table we can see the importance of risk reward.For example of 2:1 risk reward ,for 100 Rupees option if you keep 20 rupees Stoploss and 10 rupees target.you must atleast win in 7 out of 10 trades you take.And if you are trading with 1:1 risk reward , you must win in 5 out of 10 trades.That is why , I always recommend to have atleast 1:1 risk reward.But will be teaching some methods to have fixed stoploss and dynamic target in coming sections.

1. Scalpers Risk Management

As a scalper , you must control from over trading and be emotion free.

1. Emotion free - Enable points mode in oneclick trader instead of rupees mode.

2. Control Over trade - Enable Max loss mode in oneclick trader.

First of all Decide on maximum loss you can take in a day.

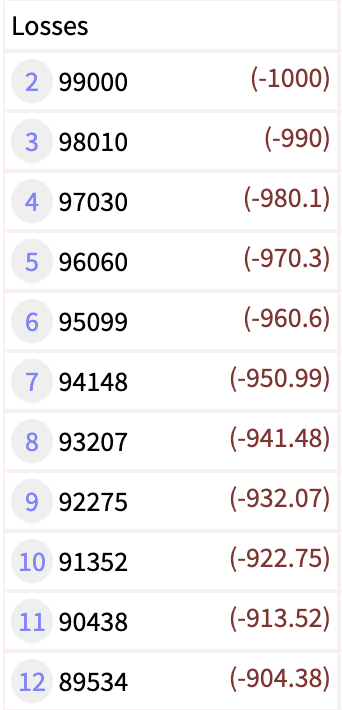

My basic Rules is take care of your losses and Profit will come automatically.Based on above Image you start with 1 Lakh capital and you are risking 1% of capital per day. on First day you have 1 lakh and 1% of 1 lakh is 1000 rupees. So you can take 1000 rupees loss.On 2nd day your capital

is 99,000 and 1% of 99,000 is 990 rupees. So you can take 990 rupees loss and so on. And even if you lose continously for 11 days , you will be losing only 10% of your capital.

But people do the mistake of taking over trading without any rules and losing 10% capital in just one day or 1 trade.Please don't do this.Atleast if you lose 10% of capital in 10 days , you would have learnt lots of things in 10 days and different market situations.

Risk (Stop Loss) :

Now as you know your Risk per day , take trades based on that.In option scalping for example if yourMax loss - 1000(1% of 1 Lakh) per day.

Stop Loss per trade - 4 points SL or 2% of premium whichever is higher.

Imagine if all your trades are in loss , You can lose upto 40 points in banknifty per day. 40x(25 BN lot size) = 1000 rupees.With 4 points SL you take 10 scalps per day. So you can take 1000 rupees loss per day maximum.obviously all your 10 trades will not be loss according to law of probability.Just control your losses and Profit will come automatically when you follow my scalping rule book .

Reward (target) :

Like I always say , only SL per trade and MAX LOSS per day is limited,Target per trade and target per day is unlimited.I have covered about trailing for singles trades in another video please Click here to go through that video.For trailing based on overall profits, check below section.Trailing based on Max profit:

I say target is unlimited , but I know over trading will make you lose all your profit you made.That is why I recommend.Trailing your total profits.

Let me show you an example.

| Trade | PNL | Difference | Max Profit | Draw Down |

|---|---|---|---|---|

| 1. | 500 | +500 | 500 | 0 |

| 2. | 1200 | +700 | 1200 | 0 |

| 3. | 1100 | -100 | 1200 | -100 |

| 4. | 1900 | +800 | 1900 | 0 |

| 5. | 1700 | -200 | 1900 | -200 |

| 6. | 1500 | -200 | 1900 | -400 |

| 7. | 2100 | +600 | 2100 | 0 |

| 8. | 2000 | -100 | 2100 | -100 |

| 9. | 1800 | -200 | 2100 | -300 |

| 10. | 1600 | -300 | 2100 | -500 |

Suppose you are trading with following rules.

Max loss - 1000(1% of 1 Lakh) per day.

Intraday Max Draw Down - 50% of Max Loss.

So you can keep scalping until your Max drawdown amount is 50% of your Max loss.For example if your max loss per day is 1000 , you can keep scalping until your drawdown is 500 rupees from max profit.So In above example you are keeping on trading even when your loss is -400 from peak, but you are stopping your trade when you reach -500 , which is 50% of your max loss per day.

If you had fixed target of 1% , you would have ended day with 1000 Rupees. But you are trailing your profit and ended day with 1600 rupees.And trust me on your best days it will be much higher.Also since we follow max draw down in intraday , it will protect your profits.Feel free to change your Intraday Max Draw Down from 30% to 100% based on your risk appettite.

So This is how we trade with fixed Loss and Unlimited Profit.

2.Intraday Traders Risk management

For Intraday traders , It is pretty much everything same as scalper Risk management, so please go through that section before proceeding.

Like I have mentioned above if risk is 1% of 1 Lakhs , that is 1000 Rupees , In scalping you will be able to take 10 trades with 4 Rupees SL each.

But for Intraday Stop Loss will be something like 20 points or 10% of premium whichever is higher.So you can take only 2 trades per day with 20 points SL each.i.e 500 Rupees risk loss per trade.

Dont be confused that you must stop trading if your 2 trades Stop loss have been hit .See below example to understand this better.

| Trade | PNL |

|---|---|

| 1. | -500 |

| 2. | +500 |

| 3. | -500 |

Here your two stoploss has been hit , but still your Pnl is -500 , so until your max PNL -1000 , you can keep trading.But once your max SL of the day is hit , Please stop trading , no matter how good oppurtunity you get.You may recover your loss for couple of days , but 1 day will come when you will lose all your profits and more.Because your Emotion will be bad when you are in loss.This is also another reason why I tell you guys to continue trading when in profit , because your emotion will be in good state when you are in profit.

Target For Intraday :

If you are following Long term signals , Exit you trade either on SL hit , Trail hit or Target hit.For example if you are Buying at the beginning of green signal , Exit your position when green signal is turning blue or red color.And Vice versa for Red , exit at blue or green signal.

Systematic Trading :

If you are Intraday trader , make sure you are trading with Systematic approach.Even if you are losing for 3 or 4 days continously , you must stick to your rules. on 5th day if there is big trending move and you are able to catch it , you will be able to recover all your losses and more.But if you are not following and skipping the day , you will not be able to be successful trader.Make some rules and stick with it no matter what.

3.Positional Traders Risk management

I dont recommend Positional trading.But If I am Positional trader I would trade only with following Scenarios.

OTM option buying:

You chose the option which has premium based on your risk appettite , so even if there is big move in opposite direction , risk is under control , Here you need to have some good method to predict the next day move.Else you will lose 90% of the time because of OTM option theta decay.But If you have some system developed to predict gaps on next day , this is good method with very good risk reward.

Option Selling With hedging:

Option selling comes with edge of theta decay already , so you can do some backtesting and sell straddles / strangles along with OTM option buying as hedge.People may give you good backtest result that even in blackswan event selling straddles without hedge gives better result , but that is not my cup of tea.

If you need more profit compared to traditional straddle strangles , you can do skewed strangles if you know the direction , for example if global is in down trend for couple of days and if our Indian market is in uptrend and if you feel our market will fall , you can sell Costly Call and Cheap put with same hedging.So when the market is falling you will get good profit.

Disclaimer

I am not a financial advisor , I am just sharing my experience and knowledge with you guys , so please do your own research before taking any decision. Let me Iterate important points again

- Fixed Stop Loss

- Unlimited Target

- Trail your profit based on Max Drawdown

- Set Max Loss per day

- Follow your system if you are scalper or Intraday trader

- Make rules and stick to it